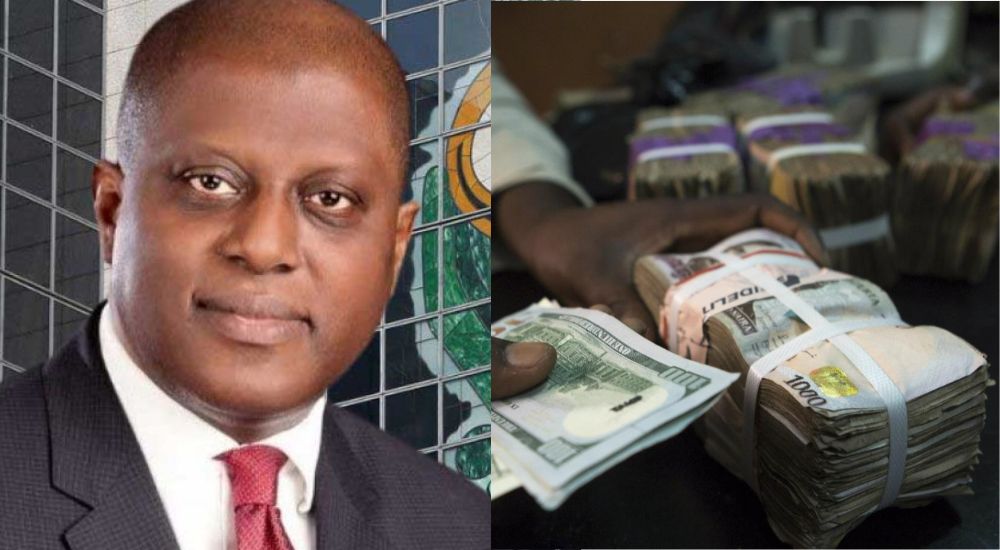

The Central Bank of Nigeria (CBN) has announced the sale of $543.5 million to authorized dealer banks in the Nigerian Foreign Exchange Market (NFEM) between September 6 and September 30, 2024.

This intervention aims to reduce market volatility driven by increased demand for foreign exchange (FX), particularly due to commodity imports and seasonal pressures.

Omolara Duke, Director of the Financial Markets Department, shared that the CBN conducted these FX sales over 11 trading days using a two-way quote system, with transactions settled under a T+2 arrangement, meaning currency exchanges occurred two business days after the trades.

A breakdown of the sales reveals the following: On September 6, $39 million was sold at rates between N1,580 and N1,605 per dollar; on September 9, $66 million was sold at N1,570 to N1,585; on September 11, $77 million was sold at N1,540 to N1,575, followed by $46 million on September 13 at the same rates.

Further transactions included $24 million on September 18 at rates between N1,530 and N1,540; $28 million on September 19 at N1,540 to N1,555; $31 million on September 20 at N1,540 to N1,545; and $17.5 million on September 23 at N1,540.

On September 26, $80 million was sold at rates from N1,570 to N1,580, and the following day, $79 million was sold at rates between N1,530 and N1,580. Finally, on September 30, $56 million was sold at N1,540.

The CBN aims to provide transparency in FX pricing by sharing these rates. It reiterated its commitment to facilitating the flow of foreign exchange in Nigeria as part of its broader FX management strategy.

This recent sale follows a significant transaction on August 11, when the CBN sold $876.26 million at N1,495 per dollar. Additionally, in late July, the CBN sold $148 million in the NFEM to authorized dealer banks over two trading days.

The CBN continues to monitor market conditions and remains determined to intervene as needed to maintain stability and ensure an adequate supply of foreign exchange.