The Central Bank of Nigeria has ordered the immediate resignation of bank directors involved in non-performing insider-related loans.

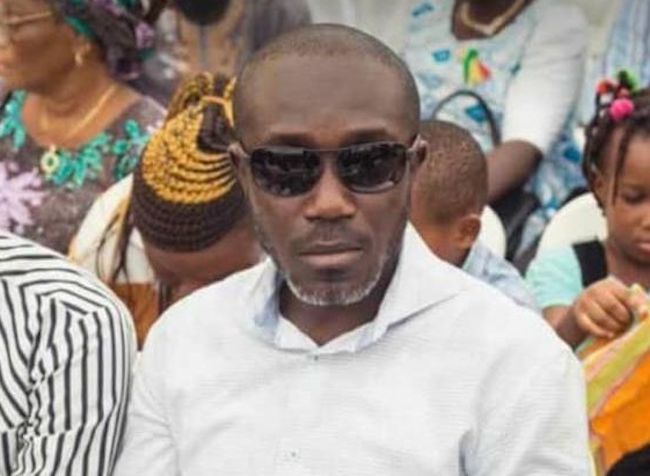

This directive was conveyed by Adetona Adedeji, the Acting Director of Banking Supervision.

The Central Bank of Nigeria (CBN) emphasised that the move was necessary to enhance corporate governance and improve risk management within the banking industry.

In a circular, the CBN stated that banks must begin taking corrective actions on these loans.

The circular specifically mandates that “directors with non-performing insider-related loans must step down immediately, while the bank is required to start remedying the loans by recovering the collateral, including the shareholdings of the affected directors.”

Additionally, in accordance with Section 19 of the Banking and Other Financial Institutions Act (BOFIA) 2020, all banks must adhere to the following instructions regarding insider-related facilities:

According to the circular, banks are to regularise any insider-related loans above the limits set in Section 19(5) of BOFIA, 2020, within 180 days.

Specifically, individual director-related loans must be reduced to comply with the 5% limit of the bank’s paid-up capital, while the total insider loans should not exceed the 10% cap on paid-up capital.

It was also noted that Banks must ensure that all such loans are regularised within the approved timeframes.

The CBN further instructed that these measures are to be enforced immediately, aligning with regulatory requirements and promoting sound corporate governance practices.